What is an ETF

What Are ETFs

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, similar to stocks. Unlike mutual funds, which are bought and sold at their net asset value (NAV) at the end of the trading day, ETFs can be traded throughout the day at market prices. This intraday trading capability allows for greater flexibility and liquidity, making ETFs a popular choice.

Source: investor.gov

ETFs pool capital from multiple investors to purchase a diversified portfolio of assets, including stocks, bonds, commodities, or a mix of these. Each ETF share represents a proportional interest in the underlying assets. This structure enables one to gain exposure to a broad market or specific sector without having to buy individual securities, offering an efficient way to diversify risk.

One key characteristic of ETFs is their transparency. ETFs disclose their holdings daily, allowing investors to see exactly what they own. This contrasts with mutual funds, which typically disclose their holdings quarterly. Additionally, ETFs generally have lower expense ratios compared to mutual funds, largely due to their passive management style. Most ETFs aim to replicate the performance of a specific index, such as the S&P 500, rather than actively selecting stocks, which reduces management costs.

ETFs also offer tax efficiency. Due to their unique creation and redemption process, ETFs typically incur fewer capital gains taxes than mutual funds. This process involves trading large blocks of ETF shares, known as creation units, which helps minimize taxable events.

ETF History and Evolution

The concept of ETFs dates back to the early 1990s. The first ETF, the SPDR S&P 500 ETF (SPY), was launched by State Street Global Advisors in 1993. This fund was designed to track the S&P 500 index, allowing one to buy a single security that represented the performance of the entire index. This innovation addressed the limitations of mutual funds, offering a product that combined the diversification benefits of mutual funds with the liquidity of stocks.

Source: ssga.com

Key milestones in the evolution of ETFs include the introduction of the first international ETF in 1996, the MSCI EAFE ETF, which provided exposure to international markets. This was followed by the launch of the first bond ETF, the iShares U.S. Treasury Bond ETF (TLT), in 2002, expanding the asset class diversity within the ETF market.

The early 2000s saw rapid growth in the ETF market, driven by increased demand for low-cost, diversified investment options. The Securities and Exchange Commission (SEC) approved the creation of more ETFs, and financial institutions introduced innovative products, including sector-specific ETFs and commodity ETFs. The launch of the iShares family of ETFs by Barclays Global Investors (now part of BlackRock) in 2000 significantly expanded the variety and reach of ETFs.

The Global Financial Crisis of 2007-2008 marked a turning point for ETFs. Their liquidity and transparency became highly valued during market volatility, leading to increased adoption by both retail and institutional investors. By 2008, the total assets under management (AUM) in ETFs had surpassed $500 billion.

Since then, the ETF market has continued to grow exponentially, driven by innovations such as leveraged and inverse ETFs, as well as smart beta strategies that combine passive and active management principles. Today, ETFs manage over $7 trillion globally, encompassing a broad spectrum of asset classes, geographic regions, and investment strategies, reflecting their evolution into a cornerstone of modern investment portfolios.

Types of ETFs

Equity ETFs

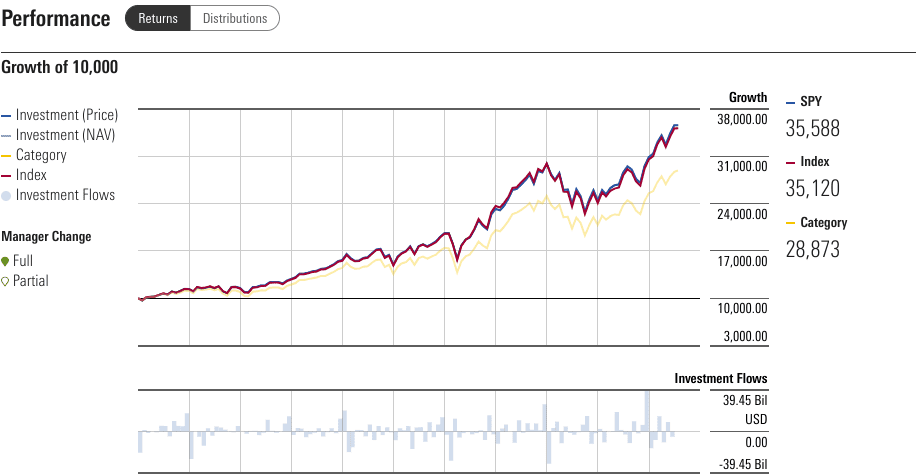

● SPDR S&P 500 ETF Trust (SPY): Tracks the performance of the S&P 500 Index, providing exposure to 500 of the largest U.S. companies. It is widely used as a benchmark for U.S. large-cap equities.

● iShares Russell 2000 ETF (IWM): Focuses on small-cap U.S. stocks, tracking the Russell 2000 Index. It offers exposure to the growth potential of smaller companies.

[SPY Performance Against S&P 500 Index]

Source: morningstar.com

Bond ETFs

● Vanguard Total Bond Market ETF (BND): Covers the entire U.S. bond market, including government, corporate, and mortgage-backed securities. It offers broad exposure to fixed-income markets.

● iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD): Focuses on investment-grade corporate bonds, providing exposure to high-quality debt issued by U.S. corporations.

Commodity ETFs

● SPDR Gold Shares (GLD): Tracks the price of gold by holding physical gold bullion. It offers a convenient way to gain exposure to gold as a commodity.

● United States Oil Fund (USO): Invests in oil futures, aiming to track the price of West Texas Intermediate (WTI) crude oil. It provides exposure to the oil market.

Sector and Industry ETFs

● Technology Select Sector SPDR Fund (XLK): Targets the technology sector, including companies from industries such as software, hardware, and IT services. It offers focused exposure to tech stocks.

● Financial Select Sector SPDR Fund (XLF): Focuses on financial companies, including banks, insurance firms, and real estate companies, providing exposure to the financial sector.

International ETFs

● Vanguard FTSE All-World ex-US ETF (VEU): Provides exposure to global markets excluding the U.S., covering both developed and emerging markets.

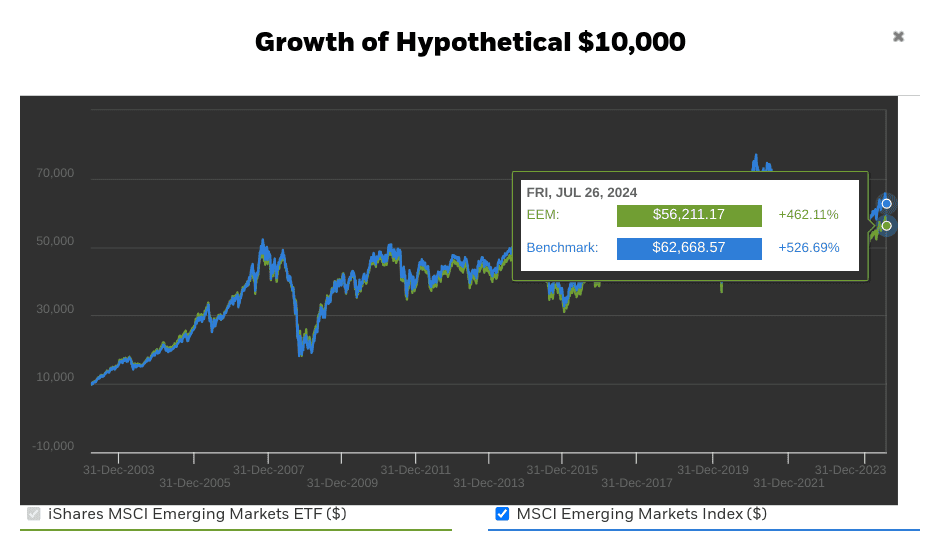

● iShares MSCI Emerging Markets ETF (EEM): Targets emerging market stocks, offering exposure to developing economies with high growth potential.

Source: ishares.com

Inverse and Leveraged ETFs

● ProShares UltraPro QQQ (TQQQ): Seeks to provide three times the daily performance of the NASDAQ-100 Index, offering leveraged exposure for aggressive.

● ProShares Short S&P 500 (SH): An inverse ETF that aims to provide the opposite performance of the S&P 500 Index, allows it to profit from declining markets.

Bitcoin ETFs

● ProShares Bitcoin Strategy ETF (BITO): Invests in Bitcoin futures contracts, providing exposure to the price movements of Bitcoin through a regulated futures market.

● Grayscale Bitcoin Trust (GBTC): Provides exposure to Bitcoin through a trust structure, holding Bitcoin directly and allowing investors to trade shares of the trust on the stock market.

Source: proshares.com

How do ETFs Work

Creation and Redemption Process

The creation and redemption process of ETFs is essential for maintaining liquidity and ensuring that ETF prices stay close to their net asset value (NAV). This process involves Authorized Participants (APs), which are typically large financial institutions with the authority to create and redeem ETF shares. APs play a crucial role in the functioning of ETFs.

● Role of Authorized Participants (APs): APs are responsible for creating and redeeming ETF shares in large blocks called creation units, which usually consist of 50,000 shares. APs interact directly with the ETF issuer to either create new shares or redeem existing ones.

● Mechanisms of ETF Share Creation and Redemption: When creating new ETF shares, an AP purchases the underlying securities that comprise the ETF’s portfolio and delivers them to the ETF issuer. In exchange, the AP receives creation units of the ETF, which can then be broken down into individual shares and sold on the open market. Conversely, when redeeming shares, the AP collects a large number of ETF shares from the market, exchanges them for the underlying securities from the ETF issuer, and sells those securities. This mechanism helps keep the ETF's market price aligned with its NAV.

Tracking Indexes

ETFs are designed to track the performance of specific indexes, such as the S&P 500 or the MSCI Emerging Markets Index. The accuracy with which an ETF tracks its underlying index depends on the methods used.

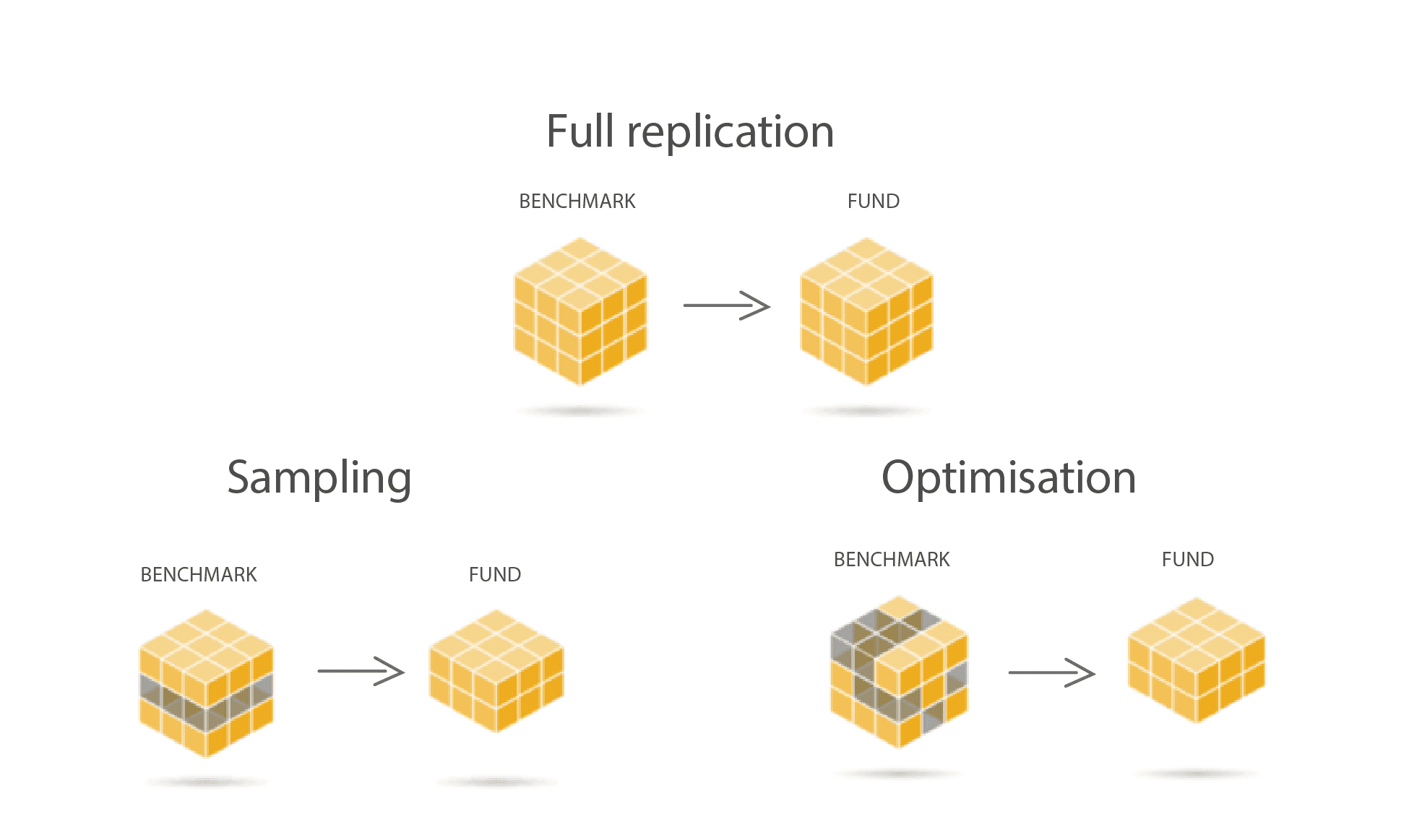

● Explanation of How ETFs Track Underlying Indexes: ETFs replicate the performance of an index by holding a portfolio of securities that closely matches the index’s composition. This replication can be done through full replication or sampling methods.

● Differences Between Full Replication and Sampling Methods:

○ Full Replication: In full replication, the ETF holds all the securities in the index in the same proportions as the index. This method ensures that the ETF closely matches the performance of the index. It is typically used for indexes with a relatively small number of highly liquid securities, such as the S&P 500.

○ Sampling Method: For indexes with a large number of constituents or less liquid securities, ETFs may use a sampling method. This involves holding a representative sample of the index’s securities. The sample is chosen to closely mimic the index’s risk and return characteristics without holding every security in the index. Sampling is particularly useful for tracking broad or complex indexes, such as those including international or small-cap stocks.

Source: vanguard.co.uk

In both methods, ETFs periodically rebalance their portfolios to reflect changes in the underlying index, ensuring continued accurate tracking. APs facilitate this process by creating and redeeming shares in response to supply and demand, maintaining the ETF’s alignment with its NAV and the underlying index. This combination of creation/redemption mechanisms and replication strategies enables ETFs to offer a practical and efficient way to gain exposure to various market segments.

Advantages of ETFs

Diversification

ETFs offer broad market exposure, allowing investors to diversify their portfolios easily. By holding a single ETF, one can gain access to a wide range of securities within a particular index or sector, which helps mitigate risk. This is particularly beneficial for small investors who may not have the capital to buy individual securities across different industries.

Cost Efficiency

ETFs typically have lower expense ratios compared to mutual funds. This is primarily due to their passive management style, which aims to replicate the performance of an index rather than actively selecting stocks. Lower management fees and operational costs translate into cost savings, enhancing long-term returns.

Liquidity

One of the key advantages of ETFs is their liquidity. Since ETFs are traded on stock exchanges, they can be bought and sold throughout the trading day at market prices. This intraday trading capability provides with greater flexibility and the ability to respond quickly to market movements. The involvement of Authorized Participants (APs) in the creation and redemption process also ensures that ETF prices remain close to their net asset value (NAV), enhancing liquidity.

Source: schwab.com

Transparency

ETFs provide daily disclosure of their holdings, allowing investors to know exactly what assets they own. This transparency helps investors make sharp investment decisions and ensures that the ETF is tracking its intended index accurately. In contrast, mutual funds typically disclose their holdings on a quarterly basis, which can leave investors uncertain about their current portfolio composition.

Flexibility

ETFs offer flexibility by covering various investment strategies and asset classes. Investors can choose from equity, bond, commodity, sector-specific, international, inverse, leveraged, and even Bitcoin ETFs. This variety allows investors to tailor their portfolios to specific investment goals, risk tolerance, and market views, making ETFs a versatile tool for both short-term and long-term strategies.

ETFs Disadvantages and Risks

Market Risks

ETFs are subject to market risks, meaning their value can fluctuate due to changes in market conditions. This volatility can lead to potential losses, especially in turbulent markets. Investors are exposed to the same risks as the securities within the ETF, including economic, political, and sector-specific risks.

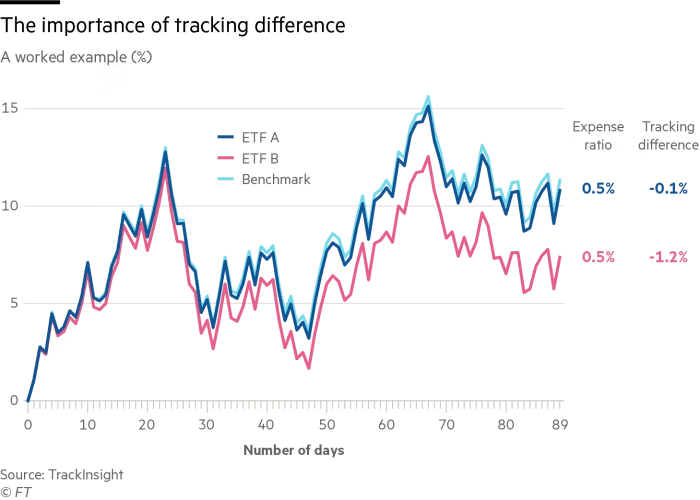

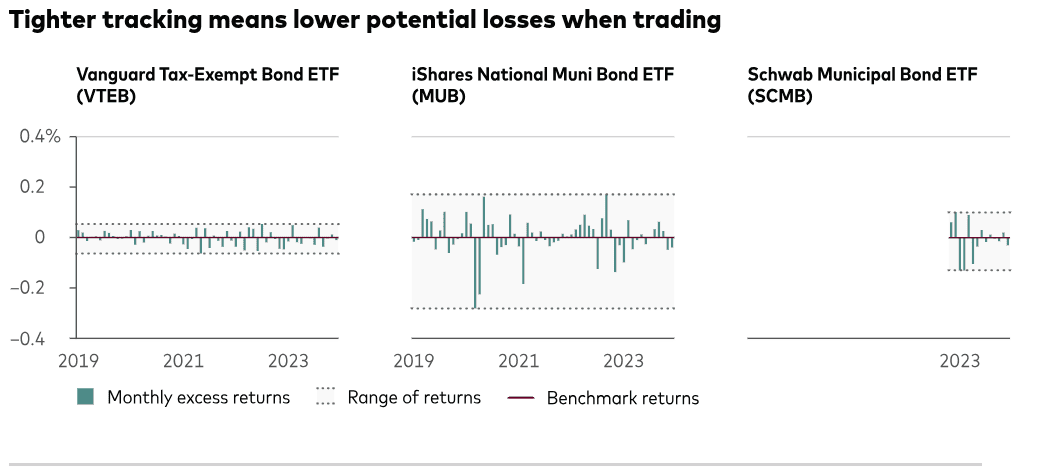

Tracking Errors

Tracking errors occur when an ETF's performance deviates from the performance of its underlying index. This can be due to various factors, such as management fees, trading costs, and imperfect replication methods. While ETFs aim to closely match their benchmark index, slight discrepancies can occur, affecting returns.

Source: ft.com

Source: corporate.vanguard.com

Complexity

Understanding leveraged and inverse ETFs can be challenging. Leveraged ETFs aim to deliver multiples of the daily performance of an index, while inverse ETFs seek to provide the opposite performance. These products are often designed for short-term trading and may not perform as expected over longer periods due to compounding effects. Investors need to fully understand the mechanics and risks involved before investing in these complex instruments.

Costs

While ETFs are known for their low expense ratios, there are hidden costs that investors should be aware of. Trading ETFs incurs commissions and bid-ask spreads, which can add up, especially for frequent traders. Additionally, less liquid ETFs may have wider spreads, increasing trading costs. These hidden costs can erode the cost efficiency advantage that ETFs are known for, particularly for small investors or those with frequent trading strategies.

How to Invest in ETFs

Brokerage Accounts

To invest in ETFs, the first step is to open a brokerage account. This involves selecting a brokerage firm, completing an application, and providing necessary identification and financial information. Once the account is approved, it must be funded by transferring money from a bank account. Many brokers offer user-friendly platforms with research tools and educational resources to help investors make sharp investment decisions.

Selecting ETFs

When selecting ETFs, investors should consider several factors:

● Expense Ratio: This is the annual fee expressed as a percentage of the investment. Lower expense ratios are generally preferable as they reduce the cost of holding the ETF.

● Liquidity: Highly liquid ETFs, which trade frequently and have tight bid-ask spreads, are easier to buy and sell at favorable prices.

● Underlying Index: Understanding the index that the ETF tracks is crucial. It determines the ETF’s exposure and potential performance.

● Performance History: Reviewing an ETF’s historical performance can provide insights into its consistency and reliability, though past performance is not indicative of future results.

Trading Strategies

ETFs can be used in various trading strategies:

● Long-term Investing vs. Short-term Trading: Long-term investors typically hold ETFs to benefit from market growth over time, leveraging the diversification and cost efficiency of ETFs. Short-term traders, on the other hand, may exploit market volatility, aiming for quick profits through frequent trading.

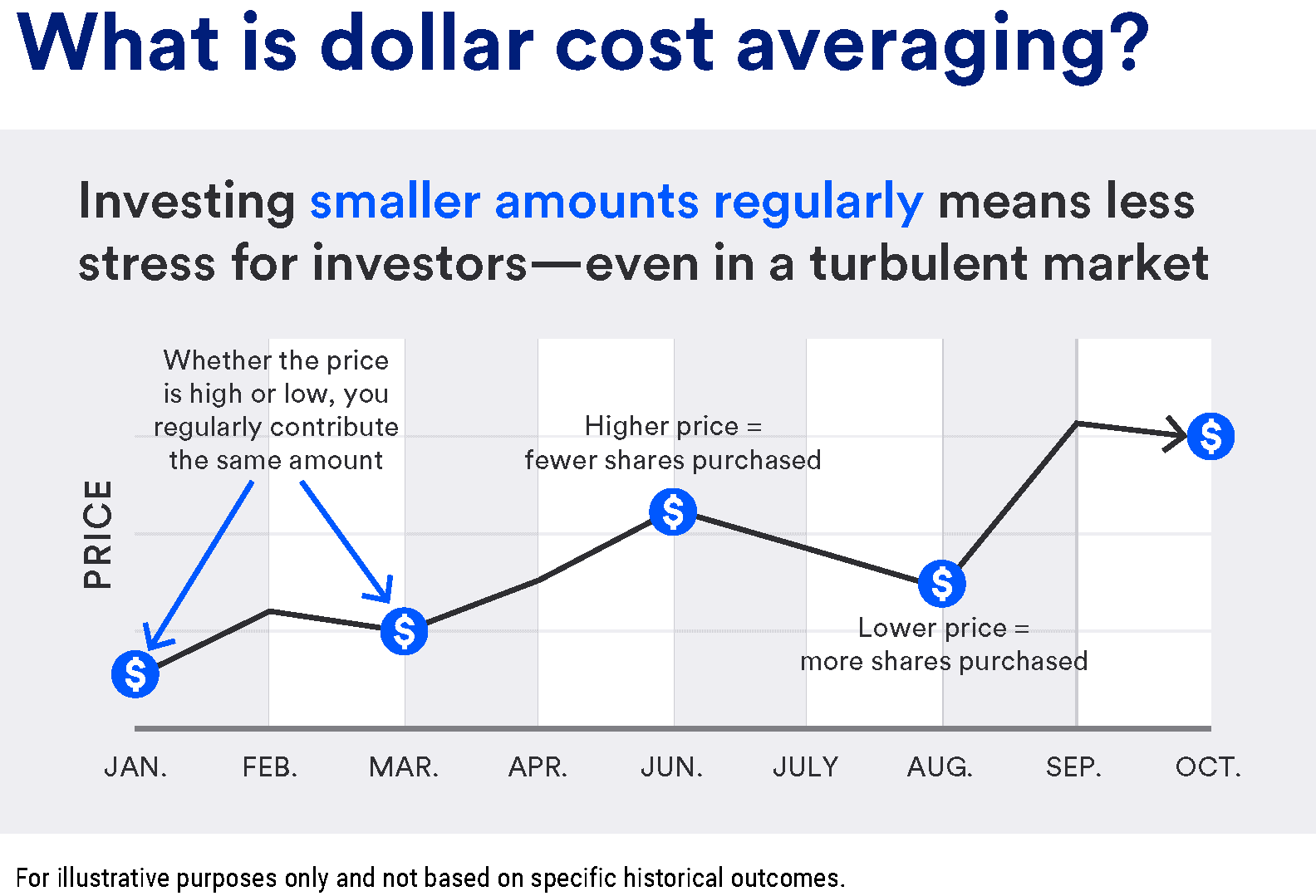

● Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount of money into ETFs, regardless of market conditions. It reduces the impact of market volatility by averaging the purchase cost over time.

Source: usbank.com

● Other Strategies: Investors might use sector rotation, where they shift investments between sectors based on economic cycles, or tactical asset allocation, adjusting their portfolio based on market conditions.

Tax Implications

Tax Efficiency

ETFs are generally more tax-efficient than mutual funds. This is primarily due to their unique creation and redemption process, which involves in-kind transfers of securities. When an investor redeems ETF shares, the ETF issuer provides the underlying securities instead of cash, reducing the need to sell securities and trigger capital gains. This minimizes the capital gains distributions that shareholders must report and pay taxes on. However, investors still face capital gains taxes when they sell their ETF shares at a profit.

Capital Gains and Distributions

While ETFs typically generate fewer capital gains distributions than mutual funds, they can still occur, especially if the ETF rebalances its portfolio or if there are corporate actions like mergers. Distributions from dividends or interest income are also taxable. These are typically paid out quarterly or annually and must be reported on the investor’s tax return.

Tax Reporting

Investing in ETFs involves specific tax reporting requirements. Key forms include:

● Form 1099-DIV: This form reports dividends and distributions received from the ETF. It includes details on ordinary dividends, qualified dividends, and capital gains distributions.

● Form 1099-B: This form reports the proceeds from the sale of ETF shares. It includes information on the cost basis, sale price, and the resulting capital gain or loss.

Source: investopedia.com

Accurate tax reporting is essential to comply with IRS regulations and avoid penalties. One should keep detailed records of their ETF transactions, including purchase dates, amounts, and sales details. Many brokerage firms provide consolidated tax documents and support tools to help investors manage their tax reporting obligations.

In conclusion, ETFs offer significant benefits, including diversification, cost efficiency, liquidity, transparency, and flexibility. They allow investors to access broad market exposure with low expense ratios, trade easily on stock exchanges, and have clear visibility into their holdings. However, they come with considerations such as market risks, tracking errors, complexity in certain ETF types, and hidden trading costs. Understanding these factors is crucial for making informed investment decisions.

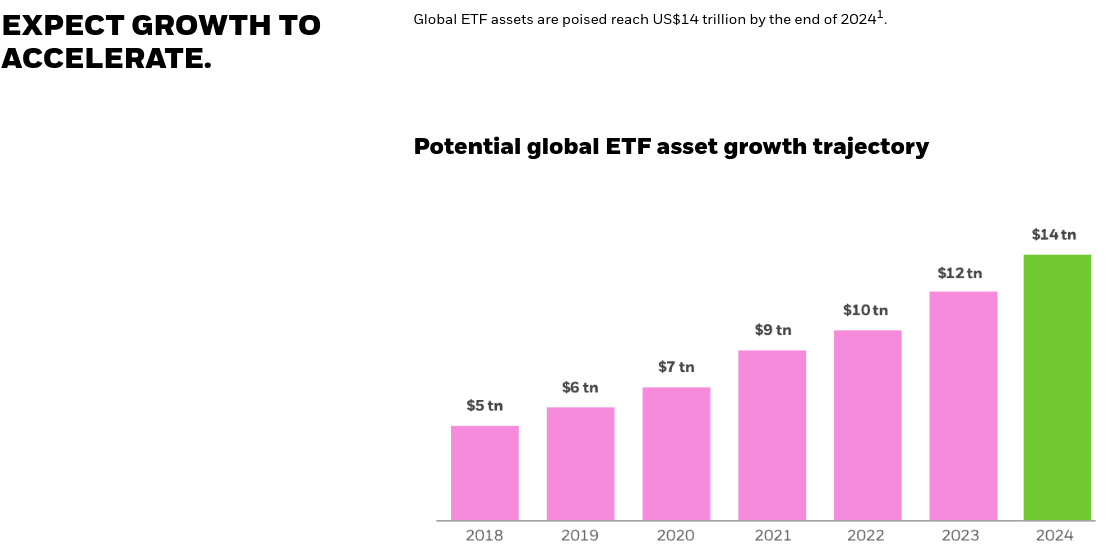

The ETF market is poised for continued growth and innovation. Key trends include the expansion of thematic and ESG (Environmental, Social, and Governance) ETFs, catering to investors’ growing interest in socially responsible investing. Additionally, actively managed ETFs are gaining traction, offering a blend of active stock selection with the benefits of the ETF structure. Technological advancements and regulatory changes are likely to enhance market access and transparency further. The proliferation of niche and customized ETFs will provide with more tailored investment options, reflecting the evolving needs and preferences in the market. As ETFs continue to evolve, they will remain a versatile and dynamic tool in the investment landscape, adapting to new market conditions.

Source: blackrock.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.